NAVigator #1: The Crypto Treasury Thesis

📬 Intro: Why I’m Writing NAVigator

If you’re reading this, you probably don’t have time to waste. Neither do I.

That’s why I started NAVigator, to track the fastest-growing yet most misunderstood sector in the market: companies putting crypto on their balance sheets. Not just Bitcoin anymore, it's ETH, SOL, and many more cryptos further down the rankings.

Some call it a fad. And sure, some of these experiments will fail. But others (particularly those led by credible crypto teams, backed by revenue-generating ecosystems) may quietly lay the groundwork for real financial integration between traditional markets and blockchain infrastructure.

At this pace, every major crypto ecosystem will eventually have a treasury strategy. The question is: who’s doing it well, what are the risks, and what can we learn from the data?

CryptoTreasuries.com is the tool that surfaces that data by parsing hundreds of SEC filings, press releases, and websites.

NAVigator is where we make sense of it.

Each week, we’ll go deeper:

- Context around the most important treasury moves

- Analysis of emerging strategies

- The best insights from around the internet

- And only the information that’s worth your attention

Thanks for giving me a few minutes of yours. Let’s make it count.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment, legal, or tax advice. Crypto assets are volatile and risky; always conduct your own research and consult professional advisors before making financial decisions.

🧠 This Week’s Thesis

The core function of a treasury company is to maintain a premium to NAV that it can leverage to accumulate more of the underlying asset. It’s a classic supply and demand equation that has them playing a chess game of narrative, transparency, and execution. As an investor, your edge comes from anticipating the next move.

Take SBET, for example. Two weeks ago, they were constrained by a 100M authorized share limit, which prevented them from issuing more equity until a vote to raise it to 500M. But demand didn’t wait. With shares scarce, the stock briefly spiked above $40, hitting an mNAV of 4x, before cooling back to $20 and a 1.4x multiple today.

Bitmine, alternatively, pegged their stock at ~$40 while raising $2B through an at-the-market (ATM) offering. Since then, BMNR has slipped to $35. While SBET was bottlenecked by supply and rode a speculative spike, Bitmine executed a disciplined capital raise, securing long-term capital with dampened volatility. It’s a reminder that treasury outcomes will be highly-dependent on execution.

📥 Filed This Week

Key filings, announcements, or treasury moves by public companies or ecosystems.

BTC

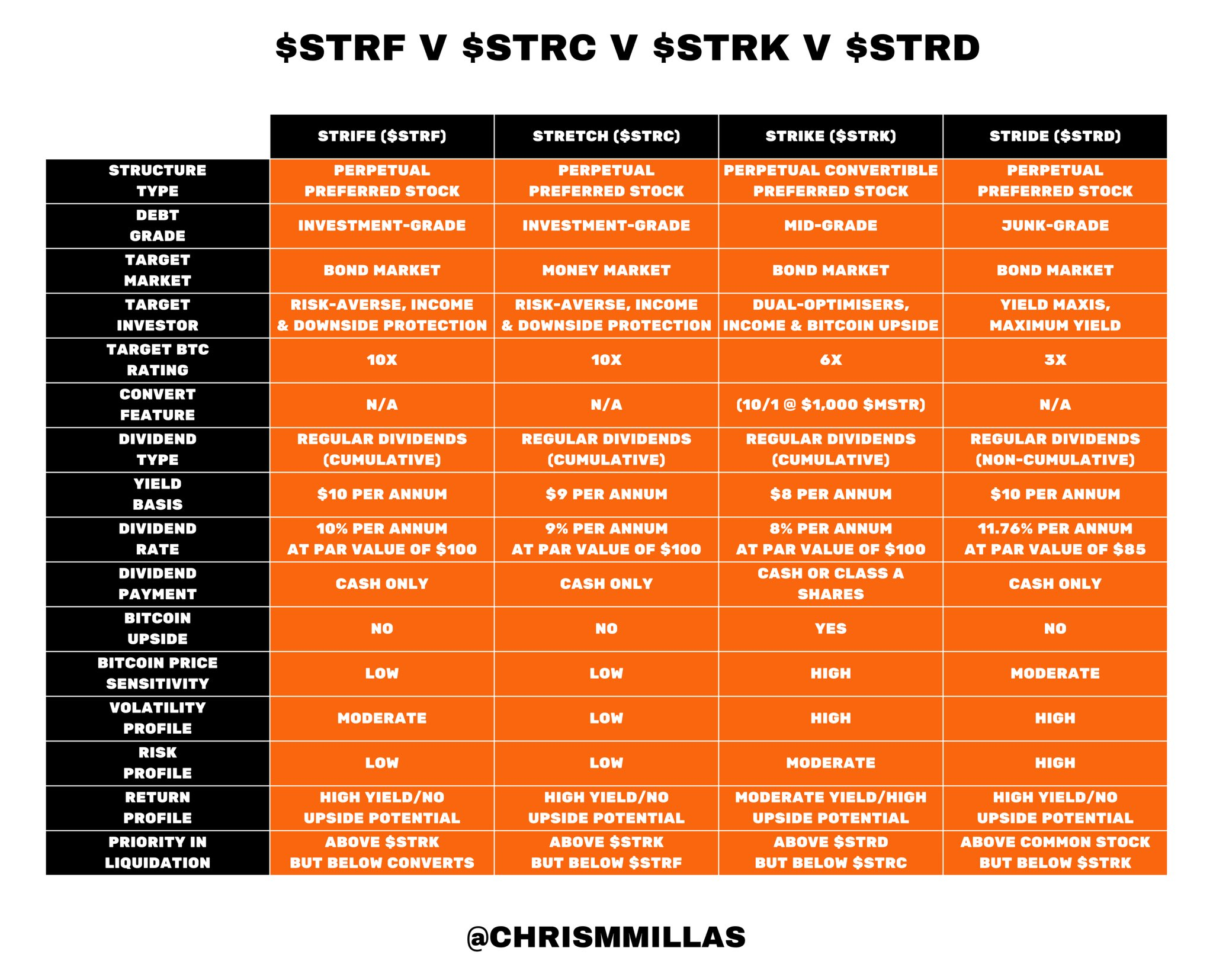

- MicroStrategy has launched its fourth Bitcoin-backed structured product: STRETCH (STRC). The company’s ability to capture demand for layered financial products with varying risk profiles is a key reason it trades at a premium to mNAV (see table above for variations). Other treasury companies will inevitably try to replicate this strategy, with mixed results. The $2.5B STRC raise enabled MicroStrategy to acquire an additional 21,021 BTC at an average price of ~$117,256. As of July 29, 2025, the company holds approximately 628,791 BTC, purchased at an average cost basis of ~$73,227 per bitcoin.

ETH

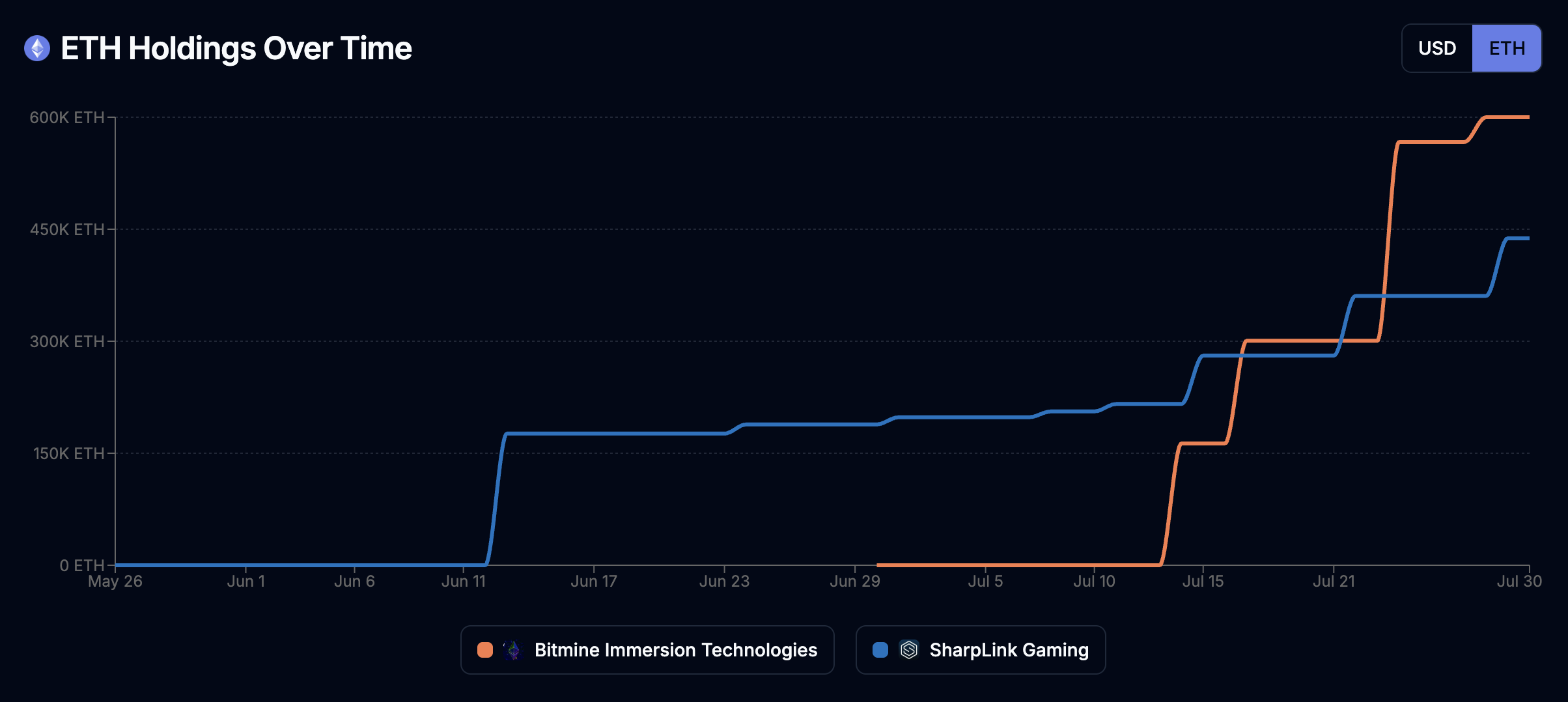

- All eyes are on who will claim the top ETH treasury spot: SharpLink, led by Ethereum and Consensys co-founder Joe Lubin, or Bitmine, backed by Peter Thiel and Cathie Wood and led by TradFi veteran Tom Lee. SharpLink reports weekly and transparently. Bitmine, on the other hand, has been more opaque: at one point holding 60k ETH in options and surprising yesterday with a $1B share buyback program. Their strategy is unclear, but their numbers speak for themselves: Bitmine has accumulated ETH faster than anyone imagined. Bitmine and SharpLink combined now hold over 1 million ETH, approaching 1% of total supply.

- Notable new ETH treasury entrant this week is ETHZilla, backed by crypto investors GSR and Electric Capital, and many DeFi heavyweights. It's unclear whether there's room for a third top ETH treasury co, but this one will stand out for its potential to leverage DeFi to get better returns.

SOL

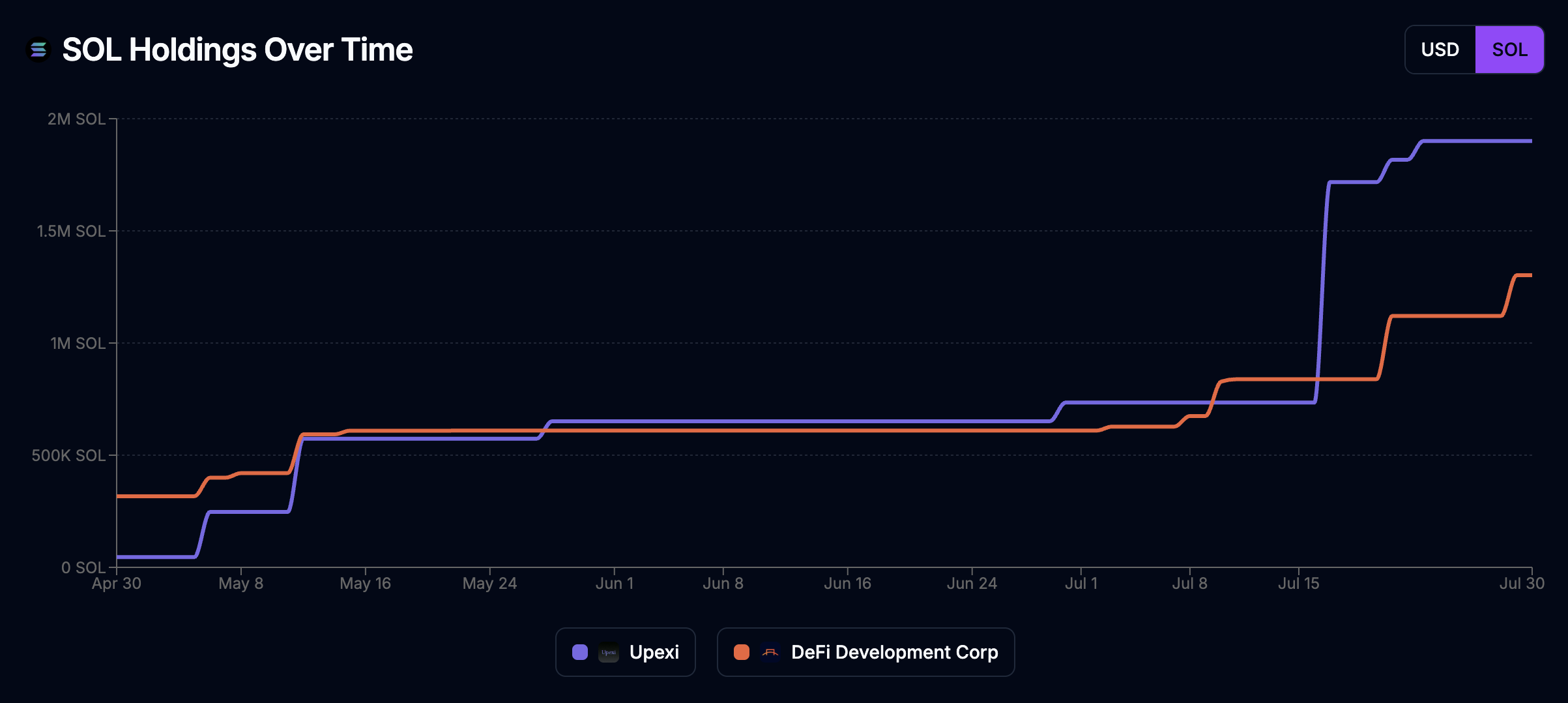

- The top spot among SOL treasury companies is also heating up. The race was neck and neck until Upexi pulled ahead with a series of large buys over the past two weeks. Despite that, Upexi is trading below 1x mNAV.

Others

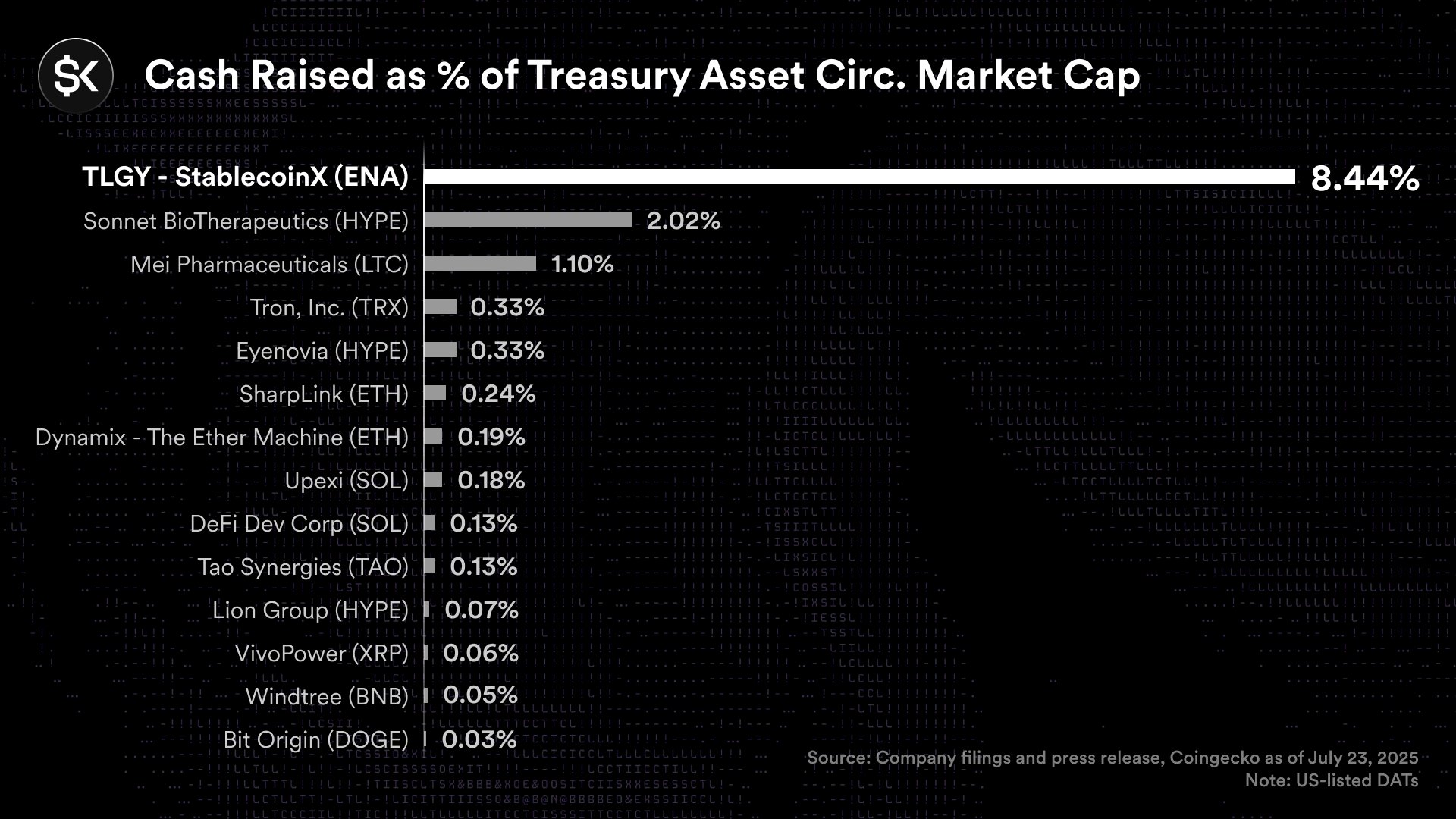

- Ethena announced last week that they’re launching a treasury company called StablecoinX, focused on accumulating their token ENA. What makes this unique is the capital raised relative to ENA’s current circulating market cap (see image above). This will be an important case study in how treasury companies perform further down the market cap rankings. The launch hopes to capitalize on the large institutional demand for stablecoin exposure revealed by the incredibly successful IPO of Circle (CRCL). We expect more to follow. Ethena founder Guy explained why they’re pursuing the strategy. TL;DR: It's to unlock equity market access for revenue-generating crypto businesses and solve the capital misallocation from oversized VC unlocks.

📊 Chart of the Week

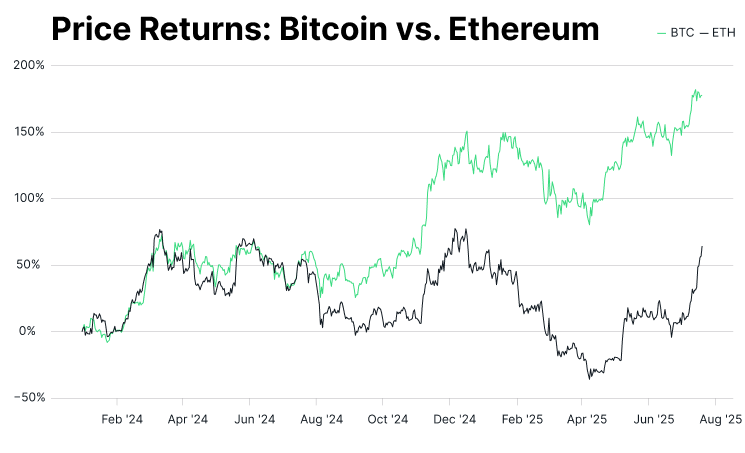

- Our Chart of the Week shows why ETH treasury companies are suddenly at the center of the narrative. Ethereum has significantly lagged Bitcoin this cycle and particularly over the past year, a trend that many assumed would continue. But institutional flows from ETFs and newly formed treasury companies are now driving a sharp ETHBTC recovery. As this chart from the Bitwise CIO memo shows, there’s still plenty of room to run if ETH is going to close the gap.

🎧 What We’re Listening To

- The Edge Podcast — “A Beginner’s Guide To ETH Treasury Companies”

DeFi Dad and Nomatic are friends of CryptoTreasuries. Together we co-wrote an early article on SharpLink when SBET was trading in the single digits. In this podcast, featuring Kyle Reidhead of MilkRoad, they do a great job discussing the crypto treasury company movement. - 1000x — “The Rise Of Crypto Treasury Companies”

Professional crypto traders Avi Felman and Jonah Van Bourg discuss crypto treasury companies from their perspective.

📌 Closing NAV

- More trackers are popping up, and that’s a good thing.

We welcome both the competition and increased transparency. I encourage you to check multiple sources as part of your research and question the differences: - mNAV is a blunt tool—asset per share (and its growth) is better.

Market cap vs NAV is useful at a glance, but varies drastically based on whether you account for cash/debt, how many shares are planned to be issued (outstanding vs fully-diluted), and how frequently each company reports its shares. A better advanced metric is how many assets are you getting per share and is that number growing? Because if it isn't, you're better off just owning the real thing. This KeyRock article written by Ben Harvey and Will Clemente gives an excellent overview of these metrics.

That does it for the first edition of NAVigator. As always, if you have any feedback let me know.