NAVigator #2: Is the Treasury Trade Over?

📬 Intro: The End of Easy Premiums

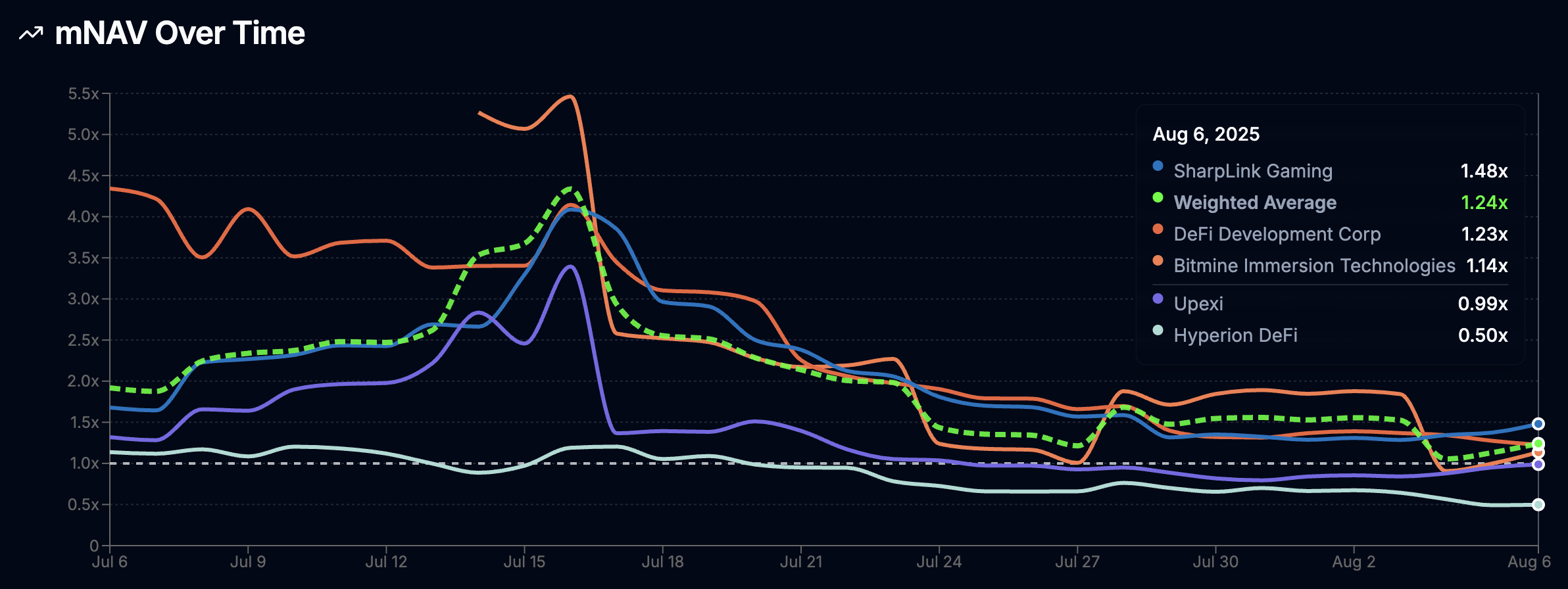

Over the past month, mNAVs have compressed across the board. Among the non-BTC treasury companies we track, the blended mNAV average (weighted by crypto holdings value) peaked at 4.3x on July 16, shortly after Bitmine began accumulating ETH. Since then, valuations have declined steadily, with the average now sitting at 1.2x and several companies trading at or below the value of their holdings.

As expected, critics are calling crypto treasuries a fading trend, arguing that the era of premiums is already over. They’re right about one thing: sustained 3–4x mNAV multiples were never realistic. But that doesn’t mean the sector is dead.

For long-term builders, crypto treasury companies still offer a structurally superior model to ETFs. Unlike ETFs, which passively hold assets, these companies can grow asset per share through equity issuance, structured financial products, and onchain deployment. A high mNAV makes that process easier (just issue shares and buy more crypto) but even without a premium, the best operators can continue growing asset per share through thoughtful strategy.

This is a winner-take-most environment. Success will depend on scale, execution, and the strength of the underlying asset. Many will struggle. Some will disappear. But the few that get it right will deserve the premium they earn.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment, legal, or tax advice. Crypto assets are volatile and risky; always conduct your own research and consult professional advisors before making financial decisions.

🧠 This Week’s Thesis: Scale, Execution, Asset

1. Scale

In this game, scale is both a result and a competitive edge. The larger the crypto holdings, the more tools a treasury company has at its disposal.

- Liquidity begets liquidity: large treasuries attract institutional flows which amplify price movements and attract further trading volume

- With enough scale, companies can issue structured products like MicroStrategy’s preferred stack or access more favorable financing.

- Dominant holders can set the tone for an asset class and shape narrative. There’s room for a #2, like Metaplanet is to MicroStrategy, but the gap widens quickly.

Small treasury companies must deliver exceptional execution or differentiate on strategy. Otherwise, they won't maintain a premium.

2. Execution

Execution is about more than just buying crypto. It’s about:

- When they buy: SBET's early ETH buys secured them a lower average ETH price than the competition

- How they buy: UPXI and DFDV accumulated discounted locked tokens and as a result have almost always been in profit. Bitmine paid a premium for ETH options to hedge against downside.

- What they do after: Staking, DeFi yield, structured financial products.

- How clearly they report: Metaplanet's data transparency has won over many investors who want to know what they're buying. DFDV also excels in this area.

Good execution increases asset per share. Poor execution wastes the premium.

3. Asset

No matter the strategy, it all comes down to what you’re holding.

- BTC remains the dominant store of value by a wide margin. Its volatility is declining and it doesn't have native yield, but neither of these matter when you're the #1 crypto asset.

- ETH is the most active narrative right now, with treasuries front-running institutional flows amid the ETHBTC recovery.

- SOL has outperformed ETH this cycle. The SOL treasury landscape has fewer competitors and higher beta, but volatility can also be a double-edged sword.

- Other smaller market cap assets are also getting treasury companies and time will tell if these last.

The formula for success is simple: hold an asset that appreciates and grow asset per share. Of course, this is much easier said than done.

📥 Filed This Week

Key filings, announcements, or treasury moves by public companies or ecosystems.

BTC

- Strategy Sets a High Floor. During its Q2 earnings call, Strategy (MSTR) announced it will only issue new shares above a 2.5x mNAV, (except to fund preferred dividends), effectively sidelining one of BTC’s largest buyers. With mNAV currently at ~1.5x and MSTR rarely trading above 2.5x, this limits BTC accumulation, and raises questions about future BTC per share growth.

- Former Bitwise Head of Alpha Strategies Jeff Park joined Procap, Anthony Pompliano’s $750M bitcoin treasury SPAC, as CIO. Park’s move shows that top TradFi and crypto-native talent increasingly view treasury vehicles as a serious capital formation model, not just a short-term trade.

ETH

- Another example of institutional adoption of crypto treasuries, Joseph Chalom, former Head of Digital Assets Strategy at BlackRock and the architect behind IBIT, ETHA, and BUIDL, joined SharpLink as Co-CEO.

- Bitmine continues to hold a clear lead in ETH treasury companies, announcing another massive 233k ETH buy to reach $3B in ETH in its first month. Unfortunately their disclosures are quite opaque so its hard to determine exact average buy price and shares issued for now.

SOL

- In a well-written article, DeFi Development Corp. acknowledges the recent mNAV compression across the entire crypto treasury sector, making the case that not all crypto treasuries are created equal. They argue that the key to surviving a crowded market is crypto per share growth, for them: SOL Per Share (SPS). DFDV believes Solana-focused crypto treasuries like theirs are best positioned for mean reversion once sentiment stabilizes, especially with fewer direct competitors than ETH treasuries.

📖 What We’re Reading

- Galaxy - The Rise of Digital Asset Treasury Companies

A nice summary from Galaxy on how crypto treasury companies raise capital, grow crypto per share, and why their success depends on sustained premiums, smart execution, and favorable market conditions.

📌 Closing NAV

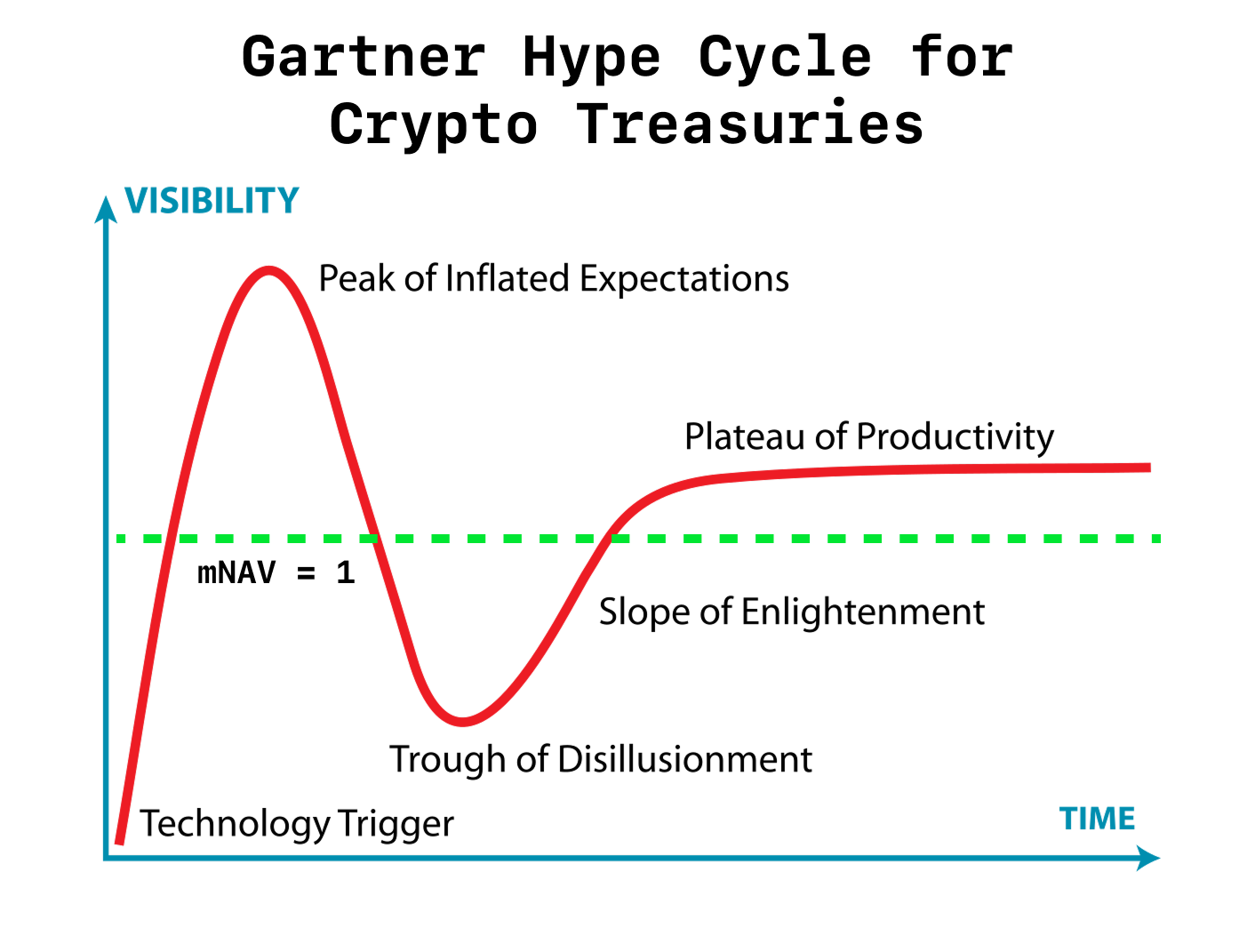

Crypto has a tendency to speedrun traditional finance. And with crypto treasury companies, we may already be watching the Gartner Hype Cycle play out, from early euphoria of 4x+ mNAVs to the current phase of compression and skepticism.

We've seen this pattern in crypto before. The Grayscale Bitcoin Trust (GBTC) famously traded at a premium for years, before flipping to a deep discount, only to converge back toward NAV with the launch of spot Bitcoin ETFs. The same principle applies here: not every premium lasts, and not every discount is permanent.

That is all for the second edition of NAVigator. As always, if you have any feedback let me know.